A sample text widget

Etiam pulvinar consectetur dolor sed malesuada. Ut convallis

euismod dolor nec pretium. Nunc ut tristique massa.

Nam sodales mi vitae dolor ullamcorper et vulputate enim accumsan.

Morbi orci magna, tincidunt vitae molestie nec, molestie at mi. Nulla nulla lorem,

suscipit in posuere in, interdum non magna.

|

By Ken, on February 3rd, 2009

We managed to survive the move over to WordPress! The change will allow us to do a lot of new and exciting things with this site. Our charts will be bigger and better, our articles will be more informative and we will have extended features like comments, whitepapers and so on . . .

This all took a long time to set up and design as we wanted to make our site as expandable as possible. There are some new features immediately available. One exciting add is that we are on Twitter! Look for us at twitter.com/globalfinance. Our “tweets” are in the sidebar and our posts from this blog appear on twitter.

We should be back to normal in a day or two, so please look for our articles and charts to be back then. Our apologies if you are coming from one of our old Blogger links (with the year and month in the URL), but we are unable to redirect to our new permalink structure. All of our old posts are here, however, and you can find them in our archives.

Thank you,

. . . And that’s how it goes.

By Ken, on December 12th, 2008  Over the weekend and during the week of December 15-19 we are moving to a privately hosted WordPress.org blog platform. This will give us the flexibility to add a number of more compelling blog features such as better charts and visuals, live market data, interactive fora, etc, . . . Unfortunately, Google/Blogger has been a difficult platform to work with as we expand and we felt it was better to make the change now while we’re still small than to try and do it later. Over the weekend and during the week of December 15-19 we are moving to a privately hosted WordPress.org blog platform. This will give us the flexibility to add a number of more compelling blog features such as better charts and visuals, live market data, interactive fora, etc, . . . Unfortunately, Google/Blogger has been a difficult platform to work with as we expand and we felt it was better to make the change now while we’re still small than to try and do it later.

Where we are going

If you are reading us as a website, please come back for the change. Our URL (globalfinance.net) will remain the same. For RSS feeds, the feed hosted by blogger will no longer work, we will update here and at the new site with the new feed address. Once we complete the move, you will still be able to access the old posts on this site at globalfinancenet.blogspot.com. However, we should be able to move all of our old content to the new site.

Thank you for being with us so far. We look forward to expanding our offerings very soon.

. . . And that’s how it goes

By Ken, on December 8th, 2008  History likes to mark eras with specific dates and events. Yesterday, Pearl Harbor Day or “the day that will live in infamy” is always known as the beginning of U.S. involvement in World War II, though the impact of the war on the U.S. started long before. While there can be no comparison, today could be known as the day that Econoblogging finally makes the mainstream. Finance and econ blogs have been influencing policy, investment and news for quite some time, but today’s Boston Globe article by Stephen Mihm memorializes the change (from the Boston Globe): History likes to mark eras with specific dates and events. Yesterday, Pearl Harbor Day or “the day that will live in infamy” is always known as the beginning of U.S. involvement in World War II, though the impact of the war on the U.S. started long before. While there can be no comparison, today could be known as the day that Econoblogging finally makes the mainstream. Finance and econ blogs have been influencing policy, investment and news for quite some time, but today’s Boston Globe article by Stephen Mihm memorializes the change (from the Boston Globe):

DURING THE PANIC of 1907, the nation’s most powerful banker, J. P. Morgan, brokered a solution to the crisis behind the closed doors of his personal library in New York City. Faced with the total collapse of the financial system, Morgan gathered together the nation’s banking titans into one wing of the library and locked the door, refusing to let them out until they had pledged to help one another through the crisis.

Morgan stopped the panic in its tracks, and his modus operandi – hammering out deals in secrecy – has become the conventional method of managing threats to the nation’s economy. This year, the response to the crisis on Wall Street started that way, too. As venerable Lehman Brothers teetered on collapse, the nation’s top bankers gathered in the offices of the Federal Reserve for a closed-door meeting at which the Treasury secretary urged them to rescue the beleaguered firm on their own. When that effort failed, Secretary Henry Paulson demanded Congress cough up three quarters of a trillion dollars to buy up bad assets, submitting next to nothing to make his case. The message was simple enough: Trust us – we know what we’re doing.

This time, however, something strange happened. A sprawling network of experts in economics and finance began picking apart the Paulson plan – live, in public, on blogs. Despite the vitriol the bloggers dished out – “Why You Should Hate the Treasury Plan” was one of the more temperate postings – this wasn’t a bunch of hacks howling from the sidelines. Their numbers included some of the nation’s top academic economists, such as Paul Krugman, Nouriel Roubini, and Tyler Cowen, along with a host of financial-industry insiders who actually knew a great deal about credit default swaps, collateralized debt obligations, and all the other esoteric instruments at the heart of the crisis.

. . . And that’s how it goes

By Ken, on December 6th, 2008  A number of commentators are going to great lengths to explain how misalignment of incentives on Wall Street and in global finance helped inflame the current economic crisis. I have a much simpler explanation that can be summed up in five simple words that every banker and analyst has heard at least one in his or her life: A number of commentators are going to great lengths to explain how misalignment of incentives on Wall Street and in global finance helped inflame the current economic crisis. I have a much simpler explanation that can be summed up in five simple words that every banker and analyst has heard at least one in his or her life:

“Don’t dilute the bonus pool.”

OPM, Inc.

Former clarion of the dot-com era Henry Blodget makes the latest attempt to explain the misaligned incentives in Why Wall Street Always Blows It. Blodget spends a large amount of text citing lack of experience and knowledge of history as reasons for analysts’ misjudgments about the market. This may be true (and is fixable), however, buried at the end of the article, Blodget hits the nail on the head:

Professional fund managers are paid to manage money for their clients. Most managers succeed or fail based not on how much money they make or lose but on how much they make or lose relative to the market and other fund managers.

If the market goes up 20 percent and your Fidelity fund goes up only 10 percent, for example, you probably won’t call Fidelity and say, “Thank you.” Instead, you’ll probably call and say, “What am I paying you people for, anyway?” (Or at least that’s what a lot of investors do.) And if this performance continues for a while, you might eventually fire Fidelity and hire a new fund manager.

On the other hand, if your Fidelity fund declines in value but the market drops even more, you’ll probably stick with the fund for a while (“Hey, at least I didn’t lose as much as all those suckers in index funds”). That is, until the market drops so much that you can’t take it anymore and you sell everything, which is what a lot of people did in October, when the Dow plunged below 9,000.

Continue reading “Don’t Dilute the Bonus Pool” »

By Ken, on December 5th, 2008  One way for government to effect prices is to intervene in the market by limiting supply. Let me first state that we here do not condone theft or criminal activity of any kind and I should also add that we commend the FBI for the work it has done the past few years under difficult circumstances. That said, in a D-Watch post on November 22, I wrote, One way for government to effect prices is to intervene in the market by limiting supply. Let me first state that we here do not condone theft or criminal activity of any kind and I should also add that we commend the FBI for the work it has done the past few years under difficult circumstances. That said, in a D-Watch post on November 22, I wrote,

The copper market is a bit healthier than Nickel, though we should remember that copper was in such short supply it was not uncommon to hear stories of copper cable theft. I haven’t heard any of those stories recently.

Today, the FBI released a report titled “Copper Theft Threatens U.S. Infrastructure”. The report is the result of a Congressional push involving new laws regulating copper recyclers and establishing an FBI task force.

Cops copping copper coppers

To illustrate the seriousness of copper theft, the FBI presented the following illustration in its report:

According to open-source reporting, on 4 April 2008, five tornado warning sirens in the Jackson, Mississippi, area did not warn residents of an approaching tornado because copper thieves had stripped the sirens of copper wiring, thus rendering them inoperable.

The FBI’s data appears to be all before the Fall of 2008, so it remains to be seen if we are correct that falling market prices will reduce copper thefts. Hopefully, the FBI has more specific crime data than anecdotal “open source” intelligence which would seem to show a decrease in theft, or at least a decreased interest in reporting it.

I. Anti-theft measures bullish for copper prices

The public should realize that the FBI’s mission is one of safety, not economics, though the two often overlap. The anecdote at the top of this post says all that needs to be said about the dangers of copper theft, though it says little about the economic consequences of anti-theft measures.

A rigorous anti-theft program would actually increase copper prices. Why? The FBI stated, “Organized copper theft rings may increasingly target vacant or foreclosed homes as they are a lucrative source of unattended copper inventory.” Selling unattended inventory back in to the market would obviously increase supply and lower prices, forcing unused copper to sit in unused homes constricts supply and raises prices. Economics 101.

II. Scarce resources

As I stated earlier, copper theft is a serious issue. It can and does threaten public safety. But there is crime and then there is Crime. We should respect law enforcement’s role in society to keep us safe, but we should not abuse law enforcement by asking it to mask political-economic failings.

In a world of falling copper demand, it should be logical that copper theft will actually decrease. Market forces exert influence on crimes that are essentially economic, this is different from Crime that occurs due to passion or psychosis. Perhaps the problem now is not as big as it was months ago. If the problem is with vacant and foreclosed homes, the FBI is dealing with economic crime not physical crime. In an era where events like the Mumbai terrorist attacks serve to remind us that we face an ever present threat from violent attack (big-C Crime), should we commit so many valuable law enforcement resources to protecting copper in vacant housing developments? Is this a repeat of Alberto Gonzales’ FBI obscenity squads?

Perhaps Congress should take a look at a market chart before it diverts FBI resources away from many of the other serious threats it has to deal with. (See chart, source Kitco Base Metals).

III. Summary

The FBI writes:

Open-source reporting from February 2007 indicates that the global copper supply tightened due to a landslide at the Freeport-McMoran Copper and Cold mine in Grasberg, Indonesia in October 2003 and a worker’s strike at the El Abra copper mine in Clama, Chile in November 2004. These events contributed to copper production shortfalls and led to an increase in recycling, which in turn created a market for copper.

Laws exist on the books to apprehend and severely punish thieves and their conspirators who commit Crime that would cause a public danger (such as stealing from emergency warning systems). Since it seems that we are back within pennies of the November 2004 prices, the price point cited that “created a market for copper”, and the future for theft is confined to “vacant or foreclosed homes”, don’t the economics undermine the argument for copper cops?

. . . And that’s how it goes

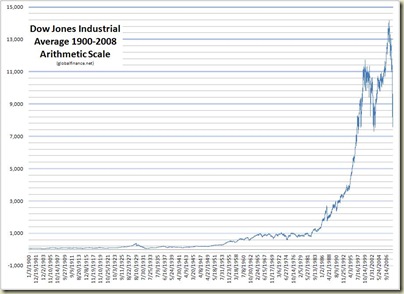

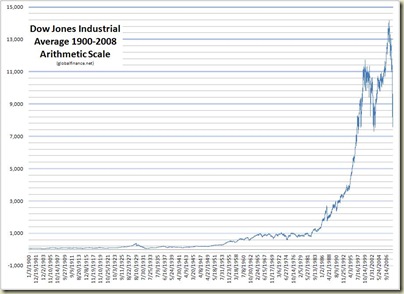

By Ken, on December 1st, 2008  We have done some earlier posts on Dow charts to illustrate the predicament today’s market is in. The utility of Dow charts (and the Dow as market proxy) is debatable, but the charts provide an interesting tool for overall market analysis. Below are the updated charts from January 3, 1900 to market close December 1, 2008. We have done some earlier posts on Dow charts to illustrate the predicament today’s market is in. The utility of Dow charts (and the Dow as market proxy) is debatable, but the charts provide an interesting tool for overall market analysis. Below are the updated charts from January 3, 1900 to market close December 1, 2008.

Log Us Out of This Market

The first chart is the logarithmic chart of the DJIA from 1900-2008. Log charts are useful in that they show proportional changes in the index over time. For instance, a change from 10,000-11,000 is the same as a change from 100-110, both are represented on the log chart as 10%. For those who put money to work in the market day by day (or year or decade), this is the chart for you.

For those in from the beginning . . .

And if you had money in the DJIA from 1900, here is the arithmetic chart, better for cash in – cash out measurements. For our time horizon, this would show you what happened to your dollar from 1900, or if you truncated the charts, what would happen to your cash over a shorter period of time.

I. Benefits and Disadvantages of the Dow

The Dow Jones Industrial Average charts are an interesting picture of the market. There are some benefits to using them in analysis:

- The index is made up of older companies with a long performance track record.

- The index itself is very old and has traded reliably so a good data set is available (and does not need to be historically extrapolated).

The disadvantages are:

- The Dow is price-weighted, not accounting for dividends, something critically important for market investors.

- The 30 industrial stocks are not necessarily key drivers of overall market performance (MSFT was left off for years and many foreign companies critical to global finance are not in the Dow).

II. Perspective

We’ve done a number of earlier posts with Dow charts. For our earlier charts, please see Charts to Show That Markets Don’t Always Go UP! and Dow Jones 1900-2008 Chart (Updated). More important than charts, I’d like to close with the words of the immortal finance commentator Lou Rukeyser (from The Des Moines Register):

“OK, let’s start with what’s really important tonight. It’s just your money, not your life. Everybody who really loved you a week ago, still loves you tonight. And that’s a heck of a lot more important than the numbers on a brokerage statement.

“The robins will sing, the crocuses will bloom, babies will gurgle and puppies will curl up in your lap and drift happily to sleep, even when the stock market goes temporarily insane.

“And now that that’s all fully in perspective, let me say, ‘Ouch’ and ‘Eek’ and ‘Medic!’ Tonight we’re going to try to make sense of mass hysteria, to look behind the crash of ’87, and most perilous but most important of all, to look ahead.”

. . . And that’s how it goes

By Ken, on November 30th, 2008  In Part 1 of this series, we discussed how the financial crisis came about. This discussion was very U.S.-centric, but it was a summation of a holiday dinner conversation I had to try and explain the crisis to someone on Main Street. What follows is a more expansive answer to how the crisis came about and what is being done. In Part 1 of this series, we discussed how the financial crisis came about. This discussion was very U.S.-centric, but it was a summation of a holiday dinner conversation I had to try and explain the crisis to someone on Main Street. What follows is a more expansive answer to how the crisis came about and what is being done.

Recycling Trash Assets and Pigs With Lipstick

Solutions from global policymakers for the financial crisis have been attempts to put the lipstick back on the pig of trash assets. This does not solve our problems because what is needed is wholesale recycling of the system, not just prettying things up.

I. The crisis to date

Here is a brief, biased history of actions in global finance and results so far:

U.S. The treasury and Fed correctly see part of the problem as a breakdown in credit, however, they mistake the symptom for the cause. Bailouts have been attempts to boost liquidity and stimulate lending, they haven’t worked because the problem is a solvency crisis (Bank A doesn’t know what credit problems Bank B may have, so it won’t lend no matter how much cash it has).

England. Gordon Brown was ahead of Washington in large bank bailouts and restoring solvency, though this has been at the expense of the British Pound and possibly Britain’s sovereign credit rating.

Europe. Early and even later on in the crisis, the European Central Bank (ECB) kept interest rates high, practically repeating the same mistake made by the U.S. Fed in the Great Depression. Once Euro rates came down, reforms and bailouts have been an every country for itself affair demonstrating that Europe is far more in need of recycling its system than other parts of the world.

China. The mistakes of allowing property and asset values to rise too far may work in China’s favor by forcing the government to compensate with domestic stimulus, creating a larger Chinese consumer economy. The Chinese consumer won’t be a factor this time, as China is export dependent, but it will next time, meaning China’s fate won’t be tied to that of the U.S. or Europe.

II. The three failures that led to crisis

The financial crisis occurred because of a system built on an ever crumbling foundation. That foundation is the use of credit to enable financial transactions. How we allowed the foundation of credit to go rotten was the result of three failures:

- The failure of imagination. While bankers and brokers were busy packaging mortgages, CDS, LBOs and the like, the excuse for allowing no-collateral, no-oversight, no due diligence credit to be extended to epic proportions was the mantra “in the long run, markets always go up.” Financial wizards failed to imagine a world in which prices could go down, though such information was readily available as in our post on Charts to Show That Markets Don’t Always Go UP!

- The failure of leadership. The financial crisis is one of government as much as it is one of finance. First is the misalignment of interests between money and its managers (namely, allowing banks to leave the partnership model for the corporate model). This misalignment led to the culture of excessive risk taking, immunity from failure and greed by fee or bonus. Second is governments’ unwillingness to curb the excesses because of adherence to free market ideology. Sometimes intervention is necessary to protect the free market, though that seems to have been lost on the last group in charge.

- The failure of knowledge. We are also here because we failed to understand the deals we were transacting. Ignorance is a partner to a no-collateral credit package and a high level of ignorance had to be called upon for the credit booms of the 90s and 00s. Our predicament is also our failure to know the warning signs of past situations. Many Great Depression era professionals are gone or long retired, the youngest being in their late-80s. Fewer still are people who have seen recent crises in Russia, Ecuador or Argentina and work in the Western markets of today. See our post on Stories From a Recent Depression.

III. Ending the crisis

In our next part of this series, we will discuss some ideas for getting out of the financial crisis. More importantly, we will stress why “recycling” our global financial system is a far better option than doing nothing or putting lipstick on a pig.

And that’s how it goes . . .

Page 4 of 6« First«...23456»

|

|

One way for government to effect prices is to intervene in the market by limiting supply. Let me first state that we here do not condone theft or criminal activity of any kind and I should also add that we commend the FBI for the work it has done the past few years under difficult circumstances. That said, in a

One way for government to effect prices is to intervene in the market by limiting supply. Let me first state that we here do not condone theft or criminal activity of any kind and I should also add that we commend the FBI for the work it has done the past few years under difficult circumstances. That said, in a